Duty of care

Ian Allison, Mott MacDonald’s global head of climate resilience, discusses the economic threat to ports from climate change and how owners need to think about risk right through their supply chain to protect their business.

It’s hard to over-emphasise the importance of ports for domestic and global trade. More than 80% of the things we eat, drive, use and play with are shipped by sea. So, when we talk about climate change, we’re talking trade and the everyday lives of people.

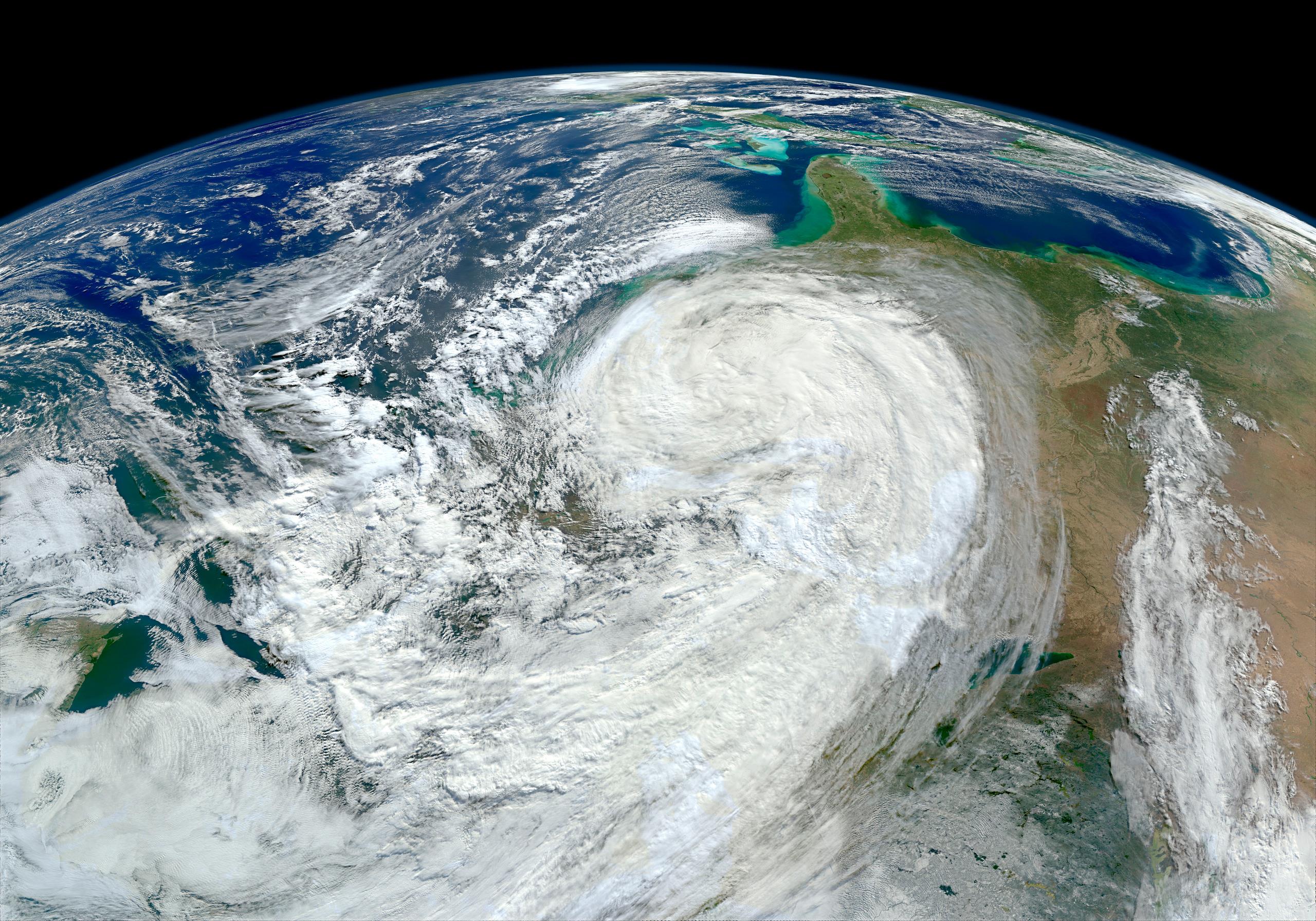

The financial case for climate resilience is strong. Shipping companies are intolerant of business disruption risk. In worst-case scenarios, ports that do nothing may be bypassed by shipping companies if they cannot guarantee a safe and efficient berth as sea levels rise, and as wind speeds and storm surges intensify.

Ports’ ability to provide reliable, high quality service to customers depends on a network of physical assets and third-party suppliers, each with its own life support network. Social, economic, financial, policy and regulatory shocks have the potential to affect all parts of this network.

House of cards

When climate events hit an insufficiently resilient asset system they can exert a shock load that triggers a collapse of functionality. Events can damage physical infrastructure, wipe out stock, disable supply chains and trigger cascade failures through interconnected asset systems. Potential vulnerabilities require continual analysis and management.

When things go wrong, the effect is cumulative. As asset systems become overstressed they start to fail more frequently. Degradation or loss of service provision can result in breach of contractual and regulatory obligations, leading to more onerous terms, tighter scrutiny and potentially shifts in policy. Loss of revenue and profitability can result in low investor confidence and harder borrowing terms exactly when additional finance is required. All this is in addition to the service disruption itself.

Realising the resilience dividend

The stark truth is that most asset owners are underprepared for the impacts of climate change. This is partly because the premise of resilience is a new one. We are only just moving from a state of mitigation into adaptation. But the cost of inaction is potentially devastating.

While the tests for vulnerability are straightforward to analyse, many ports haven’t yet made the investment to understand their risk exposure, let alone the physical measures needed to combat the risks.

The first and most important step is recognising the need to adapt. Just as there are time cycles for business planning, which embrace financial reporting, investment, contracts and asset operation, climate systems also operate to regular patterns. Port owners need to recognise this link and plan for extreme climate events just as they need to plan for the impacts of currency rate fluctuations, political elections, regulatory periods or economic cycles.

Fully resilient businesses not only deal with climate events; they rebound faster to gain a better position than their poorly adapted, less resilient competitors. Achieving continuity of operation and service provision gives organisations the opportunity to grow both market share and profitability, providing a clear ‘resilience dividend’.